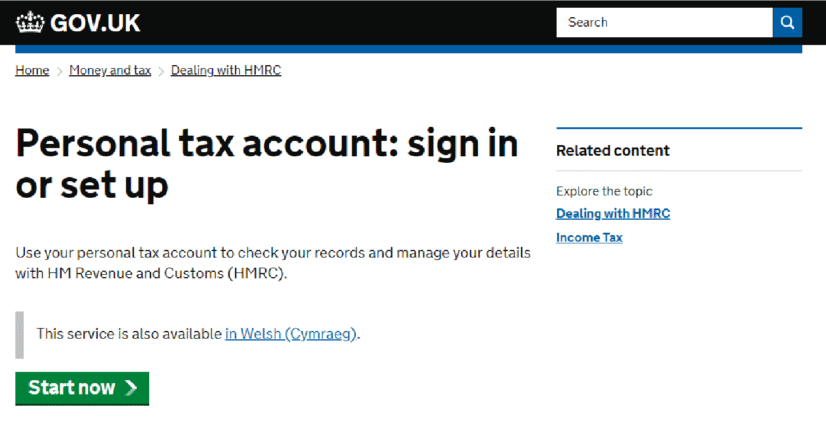

The Personal Tax Account was created by HM Revenue and Customs (HMRC) to provide UK taxpayers with safe, online access to all of their tax data in one location. When handled correctly, it enables you to keep an eye on your tax situation all year long, spot problems early, and steer clear of unforeseen costs or fines.

This guide addresses the most frequently asked questions concerning personal tax accounts, explains how to use yours efficiently, identifies typical errors, and illustrates when expert assistance is necessary.

A Personal Tax Account is HMRC’s online platform that allows individuals to view and manage their personal tax information digitally. It compiles important information like your income, taxes paid, National Insurance contributions, tax codes, self-assessment status, and pension details.

The account was launched as a component of the Making Tax Digital programme, which is part of HMRC’s larger digital reform agenda. The objective was to decrease reliance on paper-based systems, increase transparency, and modernise tax administration. Online tax platforms increase voluntary compliance and reporting accuracy when taxpayers actively interact with them, according to research on digital tax administration (Alm & McClellan, 2012; OECD, 2020).

To put it simply, rather than being something you only check once a year, your Personal Tax Account serves as a real-time summary of your tax situation.

A personal tax account should be owned and used on a regular basis by almost all UK taxpayers. This covers workers covered by PAYE, independent contractors, directors of businesses, landlords, freelancers, contractors, and pension recipients.

Your Personal Tax Account collaborates with Self Assessment services to help you keep track of deadlines, obligations, and payments during the tax year if you are required to file a tax return.

Even individuals with straightforward employment income benefit from checking their account to ensure HMRC’s records accurately reflect their circumstances.

Many tax issues result from ignorance rather than intentional errors. You can see how HMRC determines your tax and the data it uses by managing your personal tax account.

Early awareness is one of the major advantages. You can view your income as determined by HMRC, the amount of tax you have already paid, and whether your tax code has been adjusted. Transparency dramatically lowers inadvertent non-compliance and late payments, according to research on tax compliance (James & Alley, 2014).

Regular account reviews lower the possibility of unforeseen tax bills at year’s end.

HMRC relies on information provided by employers, pension providers, and other third parties. Even though this system is generally effective, mistakes can happen, particularly when conditions change.

Errors frequently occur when people change jobs, work multiple jobs, receive in-kind benefits like company cars, or transition between self-employment and employment.

Real-time access to your tax data enables you to spot irregularities early and fix them before they get worse. According to research, early detection via digital tax systems lowers taxpayer penalties and enforcement expenses (OECD, 2019).

For PAYE taxpayers, who frequently believe deductions are always accurate because tax is collected automatically, this is especially crucial.

The amount of income tax withheld from your salary or pension depends on your tax code. If it is inaccurate, you might be paying too little or too much tax without being aware of it.

Your Personal Tax Account shows your current tax code and provides an explanation of how it was determined. Allowances, estimated income from other sources, and adjustments for past underpayments or benefits are all displayed.

One of the most frequent reasons for tax overpayments and underpayments is incorrect tax codes. Studies of PAYE systems show that proactive review of tax codes significantly reduces cumulative discrepancies over time (Alm, Martinez-Vazquez & Wallace, 2010).

A personal tax review can help make sure your tax code accurately represents your situation and avoid problems in the future if your circumstances are complicated, such as having several sources of income.

Your Personal Tax Account provides a breakdown of income reported to HMRC.

This includes:

• Employment income

• Pension income

• National Insurance contributions.

This information is especially helpful if you work for multiple employers or change jobs throughout the year. It enables you to compare your payslips or payment summaries with HMRC’s records.

Examining this data lowers the possibility of inconsistencies leading to HMRC enquiries and helps self-employed people ensure consistency before submitting returns through Self Assessment tax filing.

Your Personal Tax Account becomes even more crucial if you are registered for Self Assessment. You can view filed returns, check filing deadlines, find out how much tax you owe, and pay HMRC directly.

The possibility of missing deadlines, which can result in fines and interest, is decreased by having digital access to this information. Digital reminders and easily accessible tax data improve filing timeliness and compliance, according to research on taxpayer behaviour (OECD, 2019).

Professional Self Assessment support can help you confidently fulfil your obligations if you are unclear about whether you need to file a return or what information needs to be included.

Yes. Many people are unaware of how common overpaid taxes are. It frequently happens following changes in employment, emergency tax deductions, unemployment, or incorrect tax codes.

Overpayments are typically highlighted in your Personal Tax Account, which also enables you to make online refund claims. When compared to conventional paper-based claims, digital refund systems have been demonstrated to shorten processing times and boost taxpayer confidence (OECD, 2020).

You can make sure you don’t miss any refunds you are eligible for by routinely checking your account.

It’s crucial to keep your personal data current. Your tax situation and HMRC’s communication with you may be impacted by changes to your address, contact information, or marital status.

You can immediately update these details using your Personal Tax Account. This guarantees that you receive crucial notifications, reminders, and compliance communications on time and assists HMRC in calculating the correct tax.

Missed deadlines or inaccurate evaluations may arise from failing to update your information.

A lot of taxpayers believe their personal tax account provides all the information. Although it is a helpful tool, relying on it without routine inspections can result in expensive errors.

• Assuming HMRC’s information is always correct

HMRC uses information from banks, employers, and other sources. Your tax record may be erroneous if that information is inaccurate or delayed.

• Ignoring your tax code

The amount of tax withheld from your income is directly impacted by your tax code. A lot of people don’t check it, which can result in either overpaying or underpaying taxes.

• Relying solely on the Personal Tax Account

The account displays your tax information, but it doesn’t optimise your tax position or offer customised advice.

• Overlooking wider tax planning

Ignoring reliefs, allowances, or planning opportunities that could lower your overall tax bill can result from concentrating only on what shows up in the account.

Regular use of your personal tax account enables you to plan your taxes proactively. Instead of making snap decisions, you can review your income, deductions, and liabilities over the course of the year.

This is particularly helpful for people whose income fluctuates, like contractors and freelancers, or for those who are preparing significant life changes that could impact their tax situation.

Your Personal Tax Account becomes a useful tool for long-term financial compliance and clarity when paired with expert guidance.

How to Start a Business in the UK:...

Companies House Announces Major Changes to Service Fees for...

Capital Gains Tax Demystified: Everything UK Residents Need to...

Companies House to Introduce Mandatory Identity Verification on 18...

Ready to reach out to us! Request a call back now for a personalized quote!

You can talk to us on WhatsApp