A claim is circulating online saying HMRC will deduct up to £450 from bank accounts starting on 17 November 2025. This has worried pensioners and people getting benefits from the government. The message typically doesn’t have any context, so many people think it’s a new pension or tax rule.

This information is not correct. No HMRC policy confirms a £450 deduction, and GOV.UK doesn’t show anything like this. Official changes to pensions, tax codes, or benefit repayments are always made public. A fixed “£450 HMRC deduction rule” simply does not exist.

An article on an unofficial website seems to have sparked the rumour. According to the article, the £450 figure deduction is an official government decision. The article uses HMRC’s name in a way that makes it sound official, but it does not cite any government documents or provide links to real policy updates. As soon as the headline started to circulate, it was shared on social media without being verified.

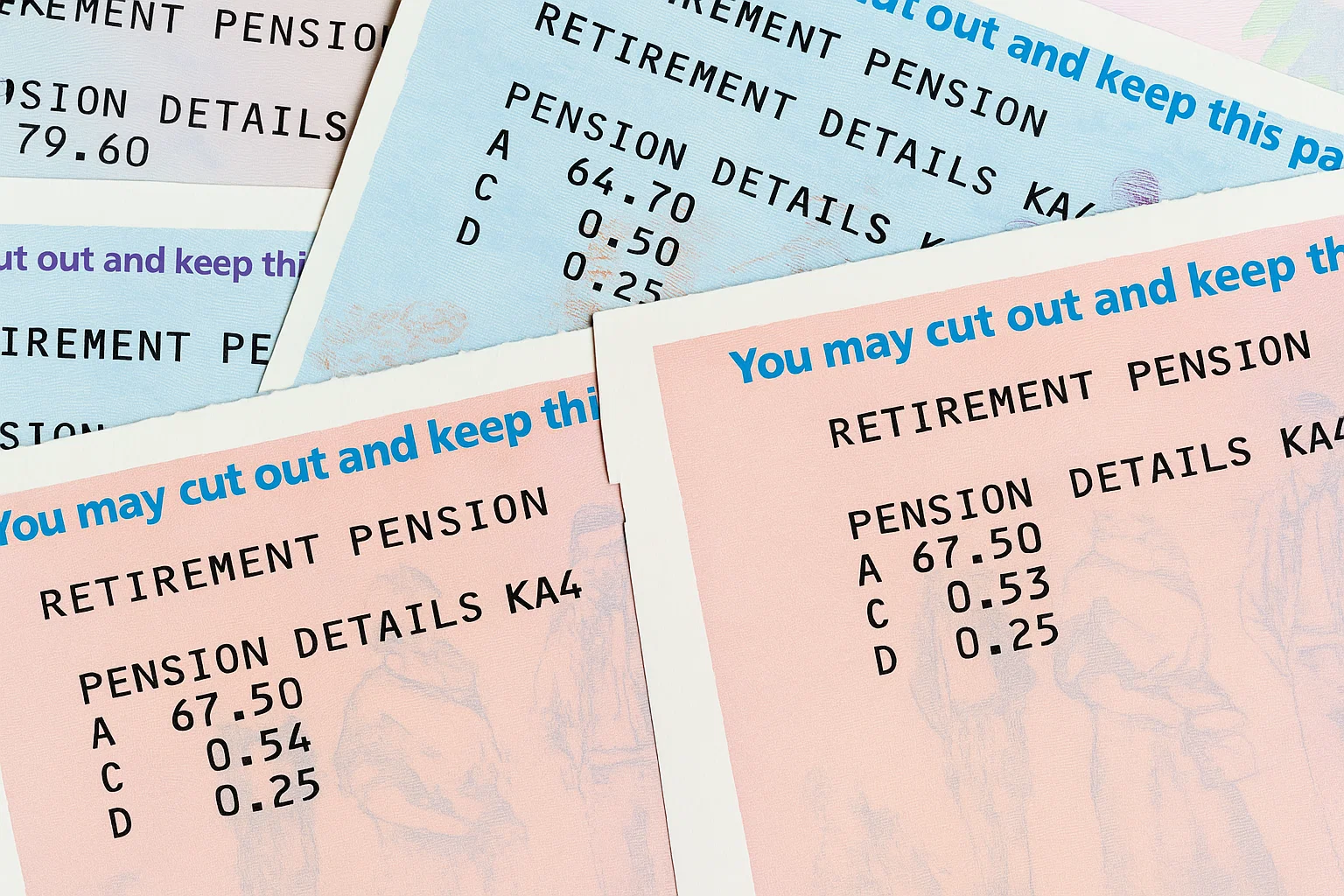

Another factor that may have contributed is the Winter Fuel Payment, which is a real and long-running government scheme. This payment helps qualified pensioners cover their winter heating expenses. Repayment rules are mentioned in certain sections of GOV.UK under specific conditions, which may have been misinterpreted. Even though these references have nothing to do with the rumour, they may appear to be a new deduction when taken out of context.

Depending on their age and circumstances, those who qualify for the Winter Fuel Payment can receive between £100 and £300. It is meant to assist with energy costs in the winter. This plan does not include a £450 automatic deduction or any new regulations that will take effect in November 2025.

Repayments linked to this scheme only apply in specific income-related cases, and they follow a clear, documented process. They are never taken straight out of a bank account without notification and are not linked to a set amount. This makes the rumour about an automatic HMRC £450 deduction even more inconsistent with official guidance.

When claims like “HMRC can deduct up to £450 from your account” begin circulating, it’s important to rely on official listings rather than social media forwards or unverified blogs. All verified HMRC updates, tax regulations, and benefit advice are posted on GOV.UK. Any significant changes pertaining to bank deductions or pensioners would first show up there.

Additionally, HMRC alerts the public to frauds that pose as government agencies. Messages that urge you to take immediate action, divulge specifics, or demand an instant deduction are typically indicators that the information is false.

When specific amounts of money are mentioned or abrupt changes to pension payments are suggested, rumours regarding tax deductions can cause needless anxiety. Knowing the source of these claims helps avoid misunderstandings and guarantees that people react to correct information rather than worrying about nonexistent policies.

Top 10 VAT Return Mistakes Small Businesses Must Avoid...

Self-Assessment Registration: A Step-by-Step Guide Got some extra cash...

Startup Essentials: What You Need to Get Right from...

How to Close a Limited Company in the UK:...

Ready to reach out to us! Request a call back now for a personalized quote!

You can talk to us on WhatsApp